Biao Teng GM: Insights & Trends

Explore the latest insights and trends in general news and information.

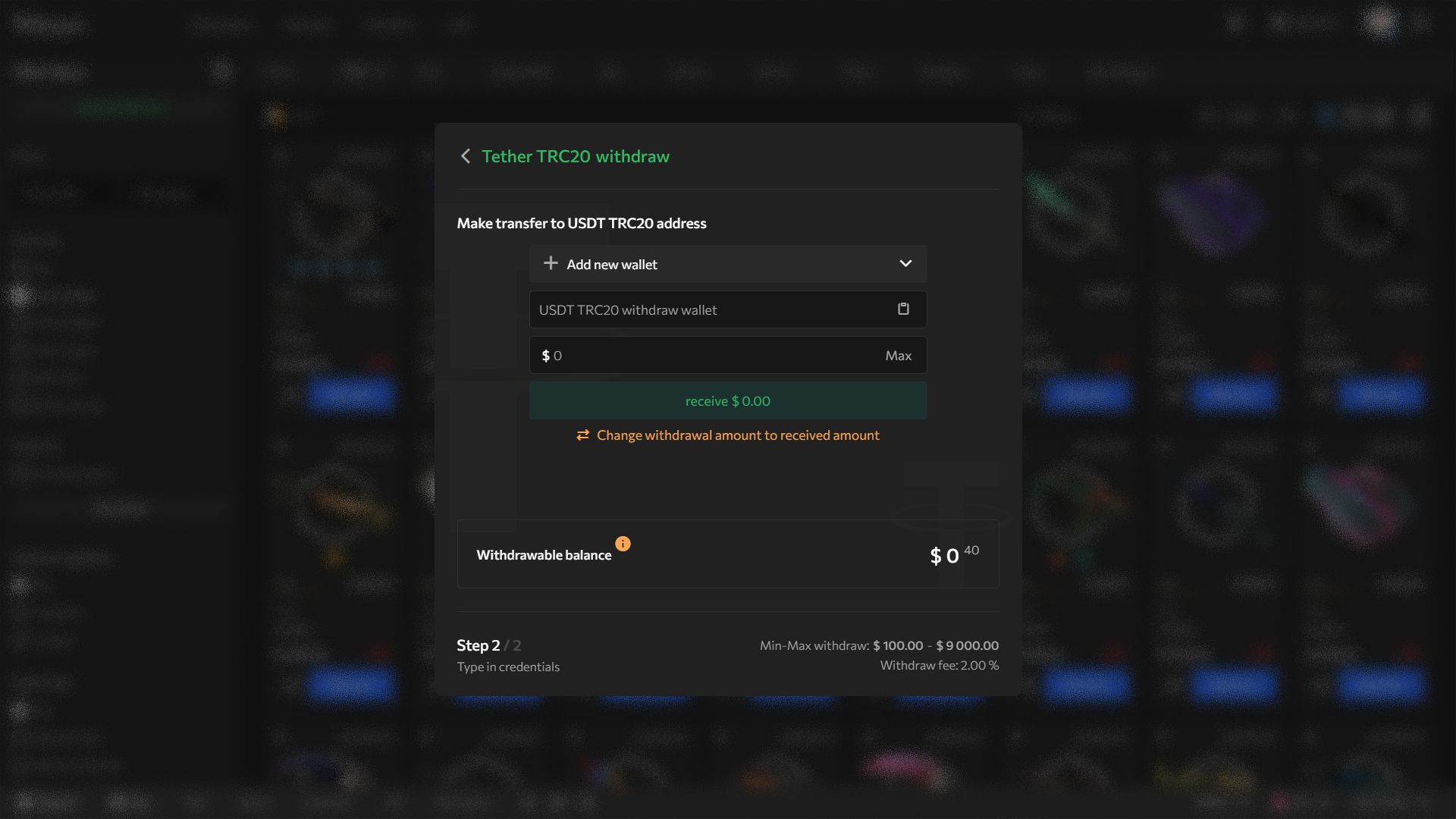

Withdrawal Whirlwind: Navigating the Maze of Methods and Fees

Discover the secrets to navigating withdrawal methods and fees! Dive into our guide to save money and simplify your transactions today!

Understanding Different Withdrawal Methods: Pros and Cons

When it comes to managing your finances, understanding the various withdrawal methods is essential. Each method comes with its own set of advantages and disadvantages that can significantly impact your budgeting and savings strategy. Common withdrawal methods include direct bank transfers, withdrawal from ATMs, and checks. For instance, direct bank transfers offer convenience, allowing you to transfer funds electronically, which is both secure and fast. However, they may include transaction fees or longer processing times depending on your bank's policies.

On the other hand, using ATMs can provide immediate access to cash, but could entail ATM fees, especially if you use machines outside your bank’s network. Checks are another option, allowing for flexibility in payment methods, although they can take longer to clear. It's crucial to weigh the pros and cons of each method. In addition, considering overhead costs and the liquidity of your funds can help you select the right strategy that aligns with your financial goals.

To take advantage of great offers, be sure to check out the latest duel promo code available for new users.

Navigating Fees: How to Maximize Your Withdrawals

When it comes to maximizing your withdrawals, understanding the various fees associated with transactions is crucial. Many financial institutions and online platforms impose withdrawal fees that can significantly impact the amount you receive. To navigate these fees effectively, start by researching and comparing different providers to identify those with the most favorable terms. In addition, consider consolidating your withdrawals to minimize the frequency of fees. For example, instead of making multiple small withdrawals, aim for larger, less frequent transactions. This strategy not only reduces the overall cost of fees but also helps in managing your finances more efficiently.

Another essential aspect of navigating fees is to understand the timing of your withdrawals. Certain platforms may charge different fees based on the day of the week or month. For instance, withdrawing during peak times may incur higher charges. To avoid these unnecessary costs, plan your withdrawals strategically. Additionally, consider utilizing tools provided by your financial institution, such as setting up alerts for optimal withdrawal times or thresholds to avoid fees altogether. By staying informed and proactive, you can ensure that more of your money goes where it belongs—in your pocket!

What You Need to Know About Withdrawal Limits and Processing Times

When engaging with online financial services, it's crucial to understand withdrawal limits and processing times. Most platforms impose specific limits on the amount you can withdraw within a given period, which can vary significantly depending on the service provider and your account status. For instance, some accounts might allow daily withdrawals of up to $500, while others may have weekly or monthly limits. These restrictions are typically in place to enhance security and to comply with financial regulations.

Additionally, the processing times for withdrawals can differ based on several factors, including the payment method you choose. Bank transfers might take several business days to process, whereas e-wallet transactions are often completed within a matter of hours. It's essential to familiarize yourself with your provider's policies to avoid unexpected delays. Remember that weekends and holidays can also impact processing times, so plan your withdrawals accordingly.