Biao Teng GM: Insights & Trends

Explore the latest insights and trends in general news and information.

When Virtual Currency Hits the Mainstream: Are You Ready?

Discover how virtual currency is transforming the financial landscape. Are you prepared for the shift? Read on to find out!

Understanding the Rise of Virtual Currency: Key Trends to Watch

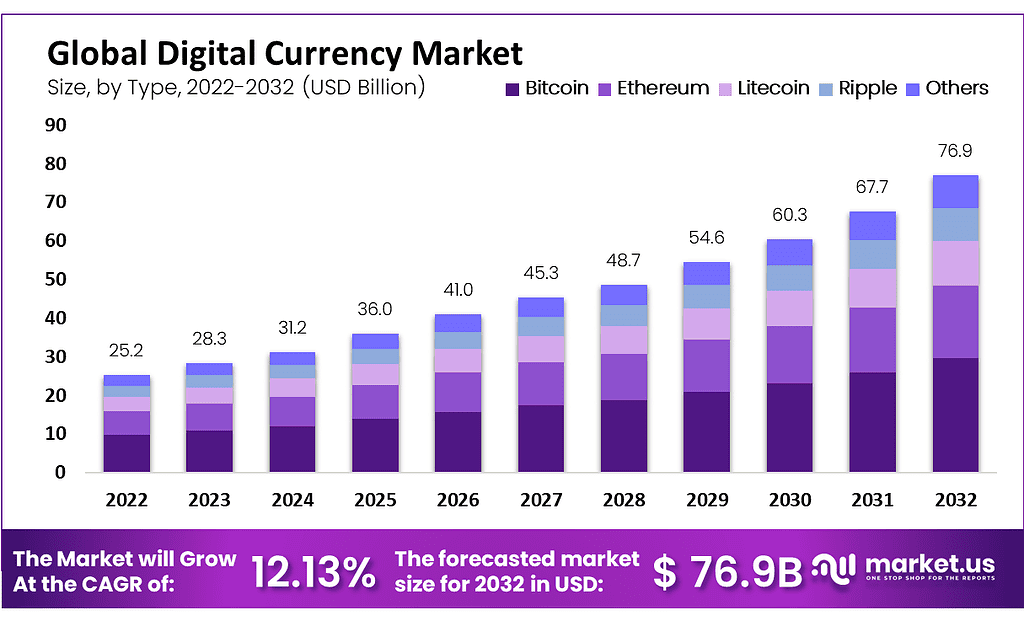

The rise of virtual currency has transformed the financial landscape, creating new opportunities and challenges for individuals and businesses alike. Over the past few years, we have witnessed significant trends that shape this phenomenon, including the increasing adoption of cryptocurrencies like Bitcoin and Ethereum, which have gained mainstream acceptance as legitimate forms of payment. Additionally, the introduction of central bank digital currencies (CBDCs) by various nations is further signaling a shift in how we perceive and use money. As more people invest in and utilize virtual currencies, it's essential to stay informed about the regulatory changes and technological advancements that accompany this growth.

One key trend to watch is the growing integration of virtual currencies in e-commerce. As online retailers begin to accept cryptocurrencies, the demand for these digital assets is expected to rise. Furthermore, advancements in blockchain technology, such as improved scalability and security protocols, will enhance user experience and expand the adoption of decentralized finance (DeFi) platforms. As we look to the future, it's crucial to monitor these developments and understand their implications on global economies and personal finance.

Counter-Strike is a popular tactical first-person shooter game series that has garnered a massive following since its inception. Players can engage in intense team-based matches where they can utilize strategy and skill to defeat their opponents. For those looking to enhance their gaming experience, you can find some great deals using the csgoroll promo code to get special offers and bonuses.

Are You Prepared for a Cashless Society? Implications of Mainstream Virtual Currency

As we transition into an increasingly digital world, the question looms large: Are you prepared for a cashless society? With the rise of mainstream virtual currencies like Bitcoin, Ethereum, and various stablecoins, traditional cash is rapidly becoming obsolete. The implications of this shift are profound. It affects everything from how we conduct transactions to how we perceive value. Consumers and businesses alike must adapt to the new landscape, which includes understanding the benefits and risks associated with virtual currencies. Embracing this change means not only accepting digital payments but also being informed about the technologies behind them.

The move towards a cashless society offers several advantages, such as enhanced convenience and security. Mainstream virtual currency can facilitate quicker transactions and reduce the need for physical banking infrastructure. However, this shift also raises significant questions about privacy, especially as digital transactions can be tracked. Moreover, reliance on technology promotes risks associated with cybercrime and regulatory challenges. To be truly prepared, individuals and businesses should educate themselves on digital wallets, blockchain technology, and the legal frameworks governing virtual currencies. Are you ready to embrace this revolution?

What You Need to Know About Security and Regulations in the Virtual Currency Landscape

As the adoption of virtual currency continues to grow, understanding the security measures and regulatory frameworks surrounding these digital assets is crucial for both investors and users. Firstly, it's important to recognize that the virtual currency landscape is often susceptible to various forms of cyber threats, such as hacking and phishing scams. Therefore, implementing robust security protocols, like two-factor authentication and the use of reputable wallets, can significantly mitigate these risks. Additionally, staying informed about the latest security practices will not only protect your investments but also enhance your overall confidence in navigating this evolving market.

On the regulatory front, governments and financial institutions worldwide are gradually establishing guidelines to regulate the use of virtual currencies. This evolving landscape means users must remain vigilant and adaptable to changes in compliance requirements. For instance, jurisdictions may impose regulations around anti-money laundering (AML) and know-your-customer (KYC) policies, which can affect how exchanges operate and how users interact with their digital currencies. Therefore, being aware of the legal implications and adhering to regulations is essential for maintaining legitimacy and operational integrity in the virtual currency space.