Biao Teng GM: Insights & Trends

Explore the latest insights and trends in general news and information.

Whole Life Insurance: A Policy That Grows Old With You

Discover how whole life insurance can be your lifelong financial ally, growing with you and securing your future. Don't miss out!

Understanding Whole Life Insurance: Benefits and Features Explained

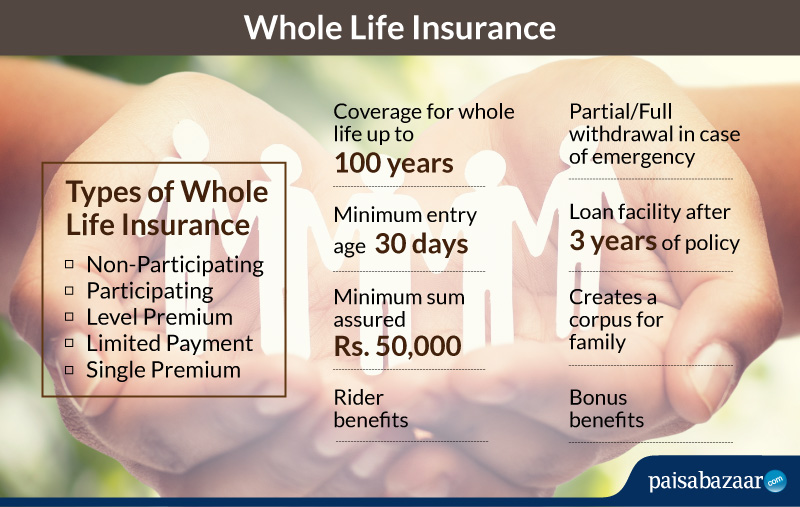

Whole life insurance is a type of permanent life insurance that provides lifelong coverage and includes a savings component known as cash value. Unlike term life insurance, which only offers protection for a specified period, whole life insurance guarantees a death benefit as long as premiums are paid. One of the primary benefits of whole life insurance is its ability to build cash value over time, which policyholders can borrow against or withdraw, providing a financial safety net. Additionally, the policy premiums remain level throughout the insured's lifetime, making financial planning more predictable.

The features of whole life insurance set it apart from other insurance products. With guaranteed cash value growth at a fixed rate, policyholders can enjoy a sense of security as their investment grows over time. Furthermore, whole life policies often come with a range of riders, such as accelerated death benefits or waiver of premium, allowing for customization based on individual needs. Understanding whole life insurance means recognizing its dual purpose: it not only protects your loved ones in the event of your passing but also acts as a financial asset that can contribute to your overall wealth and financial legacy.

Is Whole Life Insurance Right for You? Key Questions to Consider

When considering whether whole life insurance is right for you, it's essential to evaluate your financial goals, family needs, and risk tolerance. Start by asking yourself the following key questions:

- What is your primary reason for considering life insurance?

- Do you need coverage for a specific period, or are you looking for lifelong protection?

- How does your current financial situation align with the premium costs associated with whole life insurance?

Additionally, it's crucial to understand the benefits and drawbacks of whole life insurance. While it offers a guaranteed death benefit and cash value accumulation, the premiums can be significantly higher than term life insurance. Consider whether you're looking for immediate financial protection or if it's more important to build savings over time. As you weigh your options, consult with a financial advisor to determine what aligns best with your long-term financial strategy.

5 Ways Whole Life Insurance Can Support Your Financial Future

Whole life insurance offers several financial benefits that can significantly enhance your financial future. First and foremost, it provides a guaranteed death benefit to your beneficiaries, ensuring that your loved ones are financially secure in the event of your passing. This peace of mind can alleviate stress and help you focus on building your wealth. Additionally, whole life policies accumulate cash value over time, which grows at a guaranteed rate. This means you not only have the insurance coverage you need but also a growing asset that you can borrow against or use to fund major expenses in the future.

Furthermore, whole life insurance can play a vital role in estate planning. Since the death benefit is typically not subject to income tax, it can be an effective tool for passing wealth to the next generation without reducing the inheritance through taxes. Many individuals also utilize whole life insurance as a means of diversifying their investment portfolio. The cash value component offers a safe, low-risk growth option compared to more volatile investment vehicles. In summary, investing in whole life insurance not only safeguards your family’s financial stability but also creates opportunities for wealth-building and effective estate management.