Biao Teng GM: Insights & Trends

Explore the latest insights and trends in general news and information.

Whole Life Insurance: The Secret Ingredient to Financial Stability

Discover how whole life insurance can be your key to lasting financial stability and security. Unlock the secret to wealth today!

Understanding Whole Life Insurance: Key Benefits for Long-term Financial Security

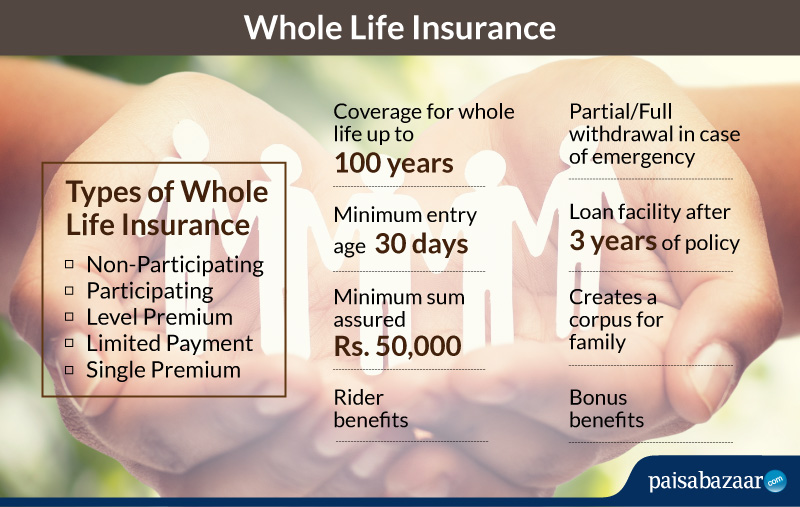

Whole life insurance is a crucial financial tool for individuals seeking long-term security and peace of mind. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers lifelong protection, ensuring your loved ones are financially secure no matter when you pass away. Additionally, whole life policies accumulate cash value over time, which can serve as a savings component that grows tax-deferred. This dual benefit not only protects your beneficiaries in the event of your death but also enables you to tap into this cash value for emergencies or future investments.

One of the key advantages of whole life insurance is the fixed premiums. Once you purchase a policy, your premium payments remain constant throughout the life of the policy, making it easier to budget for this essential expense. Furthermore, whole life insurance can provide a stable source of financial security in unpredictable economic times. The ability to borrow against the policy's cash value is another attractive feature; it offers liquidity without needing to sell off investments during unfavorable market conditions. Ultimately, understanding the benefits of whole life insurance can empower you to make informed decisions about protecting your financial future.

Is Whole Life Insurance the Right Choice for Your Financial Goals?

Whole life insurance is often considered a cornerstone of a robust financial plan, offering more than just a death benefit. Unlike term life insurance, which covers you for a specific period, whole life insurance provides lifelong coverage and accumulates cash value over time. This unique feature allows policyholders to borrow against their policy or withdraw funds, making it a potential financial resource in times of need. When evaluating whether whole life insurance aligns with your financial goals, it's essential to consider factors such as your long-term financial security, investment strategy, and overall risk tolerance.

Before deciding if whole life insurance is the right choice for you, take a moment to assess your current situation and future ambitions. Here are a few questions to ponder:

- Do you need life insurance to provide security for your dependents?

- Are you looking for a savings component to your insurance policy?

- How comfortable are you with higher premium payments compared to term life options?

Whole Life Insurance vs. Term Insurance: Which is Better for Financial Stability?

When considering Whole Life Insurance and Term Insurance, it's essential to evaluate how each option aligns with your financial stability goals. Whole Life Insurance provides lifelong coverage and builds cash value over time, which can serve as a financial asset. This option may be preferable for those looking for long-term security and a savings component, as it guarantees a death benefit and a predictable cash value growth. On the other hand, Term Insurance offers coverage for a specific period, typically ranging from 10 to 30 years, and is generally much more affordable, making it an attractive choice for those seeking financial protection on a budget.

Ultimately, the decision between Whole Life Insurance and Term Insurance should be guided by your individual financial situation and future needs. If you prioritize financial stability and are willing to invest in a policy that combines insurance with savings, whole life may be the better choice. Conversely, if you require extensive coverage for a limited time without the long-term commitment, term life might suit your needs better. Consider your financial goals and consult with a financial advisor to make an informed decision that best supports your life plan.